The Central Bank of Nigeria (CBN) has proposed that the 2023 cash transfer scheme under the National Safety Net Programme Scale Up should deploy the eNaira as vehicle. This will further entrench the CBN’s cashless policy.

The National Social Safety Net Programme Scale Up involves an $800m disbursement and this will take off in 2023 immediately after the National Assembly approves it.

Join our WhatsApp ChannelThe eNaira, an electronic currency, which the CBN introduced in 2021, is already being adopted and has made some inroads in the country’s financial system, the reason the apex bank believes it can move along with the government’s cash transfer project.

The $800m programme will be implemented through the Federal Ministry of Humanitarian Affairs, Disaster Management and Social Development.

The NASSP-SU, which was approved by the World Bank on December 16, 2021, will run till June 30, 2024.

The suggestion to use the eNaira in cash transfers during the National Social Safety Net Programme Scale Up is contained in the National FinTech Strategy document that was created by the National Financial Inclusion Steering Committee and posted on the website of the CBN.

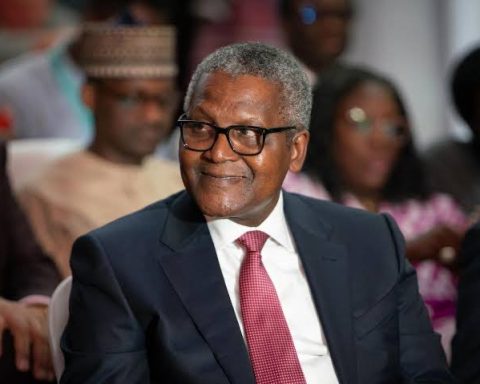

The National Financial Inclusion Steering Committee is chaired by the CBN Governor, Godwin Emefiele.

Prime Business Africa reports that the apex bank proposes that the eNaira be pre-programmed for payments to the poor and vulnerable on government’s the social register.

The eNaira is the Central Bank Digital Currency which was launched on October 25, 2021, and the objective is to catalyse financial inclusion, “payments systems efficiency improvements covering remittances and social intervention, and revenue and tax collections.”

What the document suggested:

Parts of the documents sighted on the CBN website read:

“The central bank can use a pre-programmed eNaira to pay intended beneficiaries on the social register, which could be accepted only for a specific purpose and at specifically authorised locations.

“This use case will ensure the proper use of social funds, ensure high-quality data can be collected on the performance of these programs, and help to prevent leakage or diversion of funds. This capability could be extended to other use cases in financial services and related ecosystems, where there exists a priority to maintain the integrity of funds and the purpose for which it is used.”

The document further revealed other objectives of the eNaira to include “monetary policy effectiveness, financial inclusion, payments and remittances efficiency (domestic and cross-border) and government payments.”

National Social Safety Net Coordinating Office revealed that about 12.06 million poor and vulnerable households, comprising 49.81 million individuals, are in its database for the NASSP-SU.

National Coordinator, National Social Safety Nets Coordinating Office, Mr Apera Iorwa, was reported by The PUNCH to have said in an interview that the Federal Government had, in four years, disbursed about $300m to the poor and vulnerable in its National Social Register through its N5,000 cash transfers.

According to Iorwa, two million households had benefitted on an average of five individuals per household, totalling about 10 million individuals.