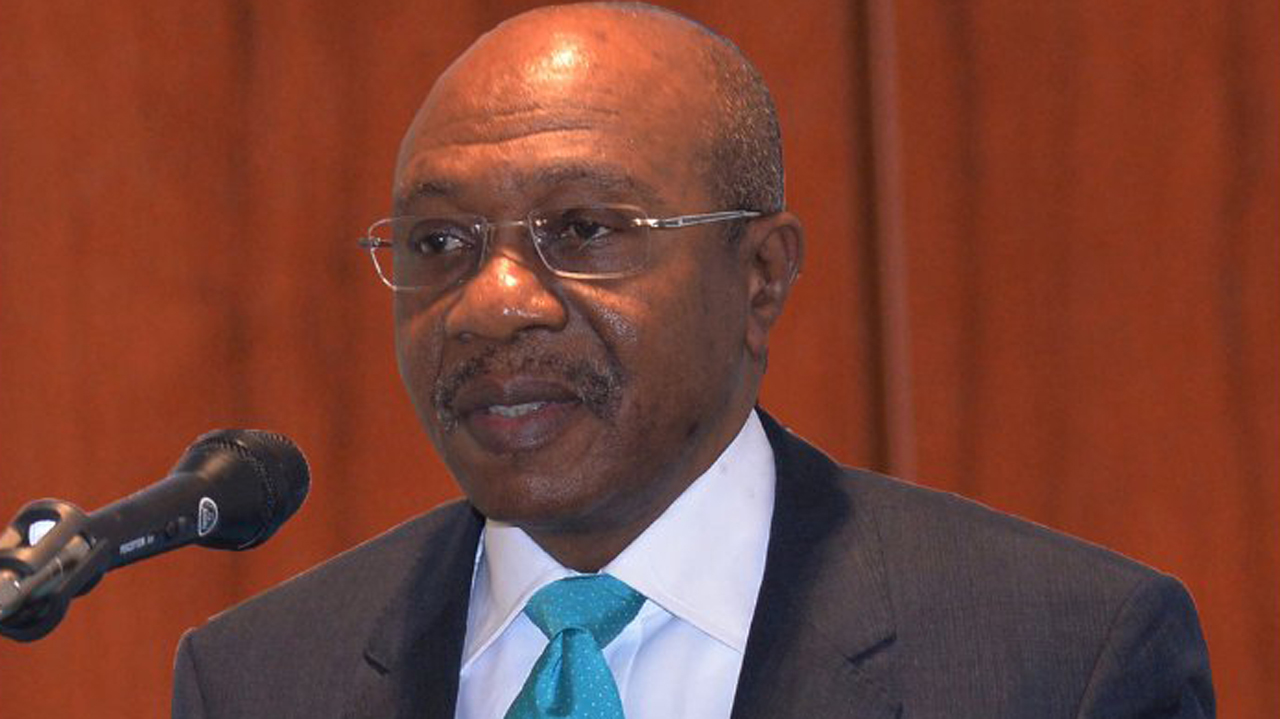

The Central Bank of Nigeria (CBN) Act 2007 needs to be reviewed to align with international best practices, the International Monetary Fund (IMF) observes.

IMF stated in its latest Report – ‘Nigeria: 2022 Article IV Consultation’ – that the CBN Act is outdated and should be revised.

Join our WhatsApp ChannelThe statement by the global body comes amid questions about the autonomy of the central bank over the controversial Naira redesign policy implementation.

CBN has come under criticism over its handling of the Naira redesign policy, which has caused scarcity of the N200, N500 and N1,000 notes, and triggerred violent protests across the country.

Despite the attacks on banks and destruction of properties, the CBN has ignored calls from Nigerians and lawmakers requesting for extension of the deadline to phase out the old N200, N500 and N1,000. The new Naira notes have been grossly insufficient to meet demand as Nigeria prepares for a critical election.

In the IMF report, the global body called for the autonomy of the CBN to remain and requested that government officials should be excluded from CBN’s board and committees.

IMF said the CBN Act should be reviewed to safeguard the independence and tenure of central bank officials, among others.

“To strengthen the central bank’s autonomy and governance and to establish price stability as its primary objective, the 2007 CBN Act needs to be modernised,” the report reads.

IMF also told the CBN to resume the yearly release of its financial statements in line with international standards.

“The CBN’s financial reporting practices should be bolstered through full adoption of International Financial Reporting Standards and resumption of publication of annual financial statements. More broadly, the CBN should take steps to implement the recommendations from the assessment (the 2021 Safeguards assessment) as progress has been limited thus far,” IMF said.

The report further stated: “However, the CBN Act needs to be modernised to enshrine price stability as the primary objective, strengthen the central bank’s autonomy including by reducing the presence of government officials at the board and the CBN’s committees, and by safeguarding the independence and tenure of central bank officials. Legal amendments should also provide for independent oversight over the CBN, including establishing a majority non-executive board and an audit committee that is independent of executive management.

“Financial autonomy should be safeguarded through clear statutory limits on credit to government and prohibition of quasi-fiscal operations and developmental lending activities, which need to be phased out. Financial reporting practices need to be bolstered through the full adoption of International Financial Reporting Standards and resumed publication of annual financial statements. Thus far, limited traction has been seen on implementation of the recommendation and staff continues to engage with the authorities on these issues.”

Follow Us