The Godwin Emefiele-led Central Bank of Nigeria (CBN) has warned that the financial regulator will start arresting persons selling the Naira notes.

In a circular released on Thursday, 2, February 2023, the central bank said it learnt that persons are hawking and selling the banknotes to the public.

Join our WhatsApp ChannelPrime Business Africa had gathered that Point of Sales (PoS) operators are selling the old Naira notes, charging N500 for every N5,000 withdrawal or N100 for every N1,000 withdrawal.

This publication gathered that PoS operators are buying the old N200, N500 and N1,000 notes from market women or persons in the wholesale business due to the scarcity of redesigned Naira and the non-availability of old currencies in the same denominations.

As a result, PoS operators who previously charge N100 for withdrawal of N5,000 passed the cost of buying the banknotes from market women to the customers, hence, N500 per N5000 withdrawal.

According to a PoS operator in Alagbole-Akute Road, Ifo, Ogun State, who spoke with Prime Business Africa on condition of anonymity, banks are not providing money for PoS operators, and some that are lucky to receive are given just N5000.

It was gathered that the charges vary by area and state.

CBN moves against the sale of Naira

The central bank said it will clamp down on persons involved in the selling of Naira as it’s against the Central Bank of Nigeria Act 2007 to engage in local currency trading.

In the circular, the apex bank cited CBN Act 2007 (As amended) Section 21(4), which states that “It shall also be an offence punishable under Sub-section (1) of this section for any person to hawk, sell or otherwise trade in the Naira notes, coins or any other note issued by the Bank.”

Nigeria’s financial regulator also condemned people stocking and aggregating the newly introduced banknotes after serially obtaining the redesigned currencies from ATMs.

Also, it expressed concerns that unregistered persons and non-bank officials are swapping banknotes for members of the public, purportedly on behalf of the CBN.

The CBN said it will apply the law to bring the aforementioned persons to book, including those disrespecting the Naira at birthdays, weddings, and funerals.

“the Central Bank of Nigeria (CBN) is collaborating with the Nigeria Police, Federal Inland Revenue Service (FIRS), the Economic and Financial Crimes Commission (EFCC) and the Nigerian Financial Intelligence Unit (NFIU) to address the unpatriotic practice.

“We, therefore, warn Nigerians, particularly those at social functions such as birthdays, weddings and funerals, to desist from disrespecting the Naira or risk being arrested by law enforcement agencies,” the circular reads.

Expert says banks behind the trade of Naira

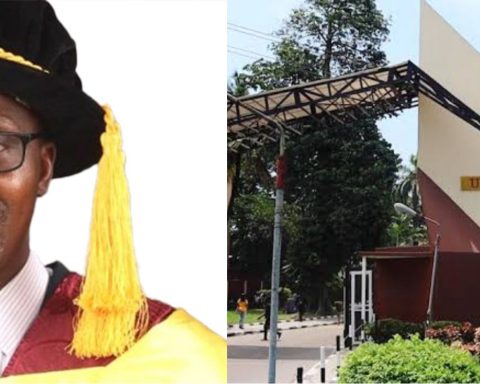

The founder of the Centre for the Promotion of Private Enterprise (CPPE), Muda Yusuf, blamed banks for the current scarcity of banknotes and the sale of the Naira.

Yusuf, in a Twitter space with Prime Business Africa, said trading in Naira has become an enterprise due to the backing of bank officials making the Nigerian currency available through the backdoor, but saying new cash is not available when people go to the bank to withdraw.

Speaking on the currency situation, Yusuf said: “Then he (Emefiele) spoke about hoarding. Who are we going to accuse of hoarding currency notes?

“Even before the redesign, if you go to the bank, you don’t find the new currency notes (but) if you go to parties, event centres, you find the new currency.

“Are the new currency notes dropping from heaven? Are they not coming out of the banking system? Only recently, I heard that the DSS arrested some people, and some bank officials have been implicated. It is not a new thing, this thing has been existing for long, it has become an enterprise.”

Follow Us