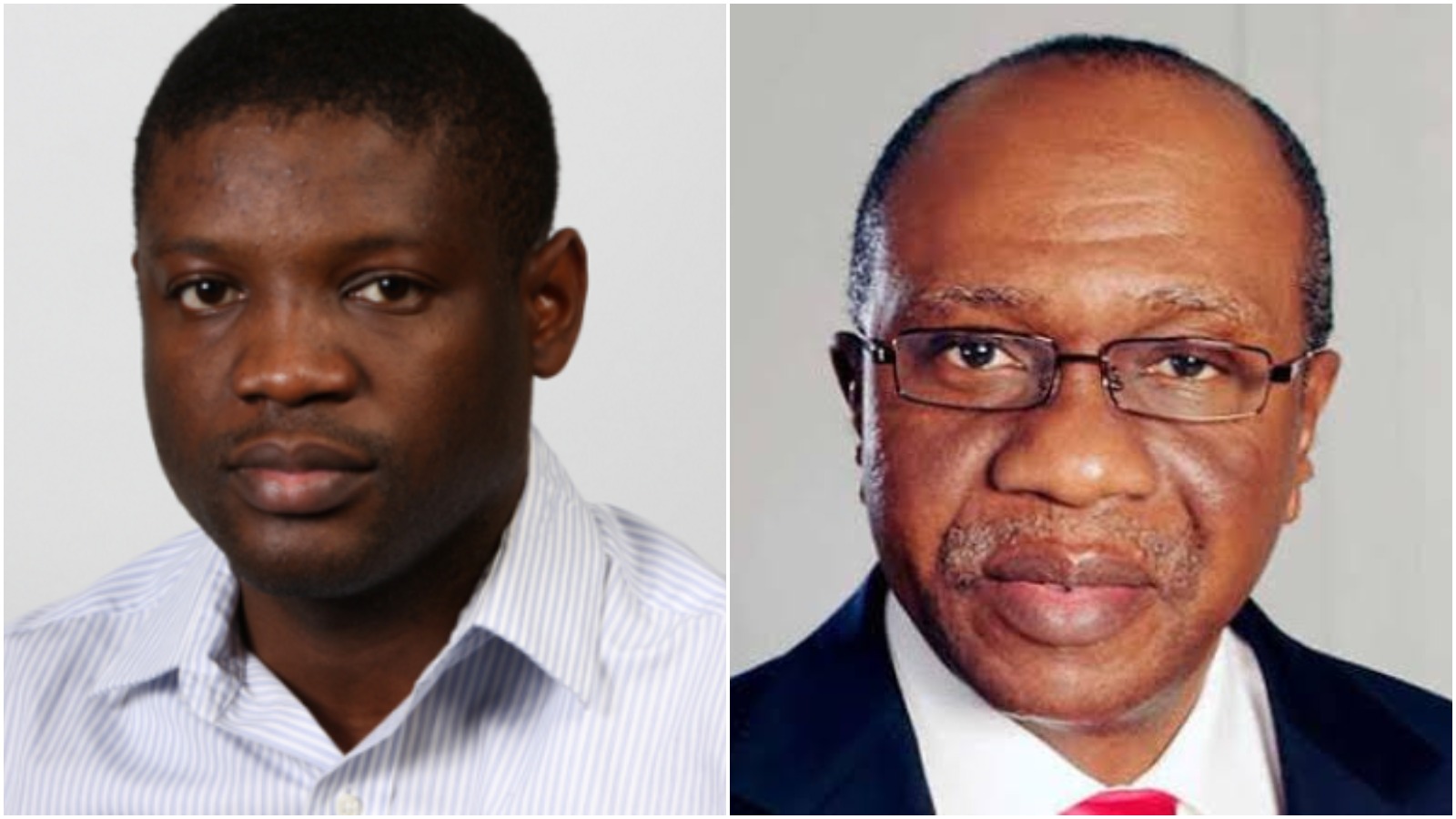

David Ajala, the Chief Executive Officer and founder of Nigerian cryptocurrency exchange, NairaEx, said the Central Bank of Nigeria (CBN) ban on cryptoasset trading affected user transactions in the Nigerian digital currency market.

At the start of November last year, bitcoin trade volume in Nigeria’s crypto market fell to 2.8 million, down from six million recorded in early third quarter of 2021, as the apex bank directive to banks created a bottleneck around crypto exchange.

Join our WhatsApp ChannelRecall that the CBN Governor, Godwin Emefiele, had ordered banks to stop engaging with cryptocurrency exchanges in Nigeria, and close accounts related to digital currency transactions. This created a setback, compelling crypto holders and prospective investors to find an alternative channel to trade.

Ajala told Prime Business Africa in an interview that the ban threw a spanner in the works, but the clampdown also increased crypto popularity among Nigerians, exposing more people to digital coin, as interest moved upward, despite fear of the financial regulator’s crackdown.

“Immediately the ban was announced there was a drop in user transactions because people could not withdraw or deposit funds. We switched to a peer-to-peer model to resolve this issue.” Ajala said, explaining the change in NairaEx business strategy and user approach model.

NairaEx founder added that, “There was already an ongoing conversation about cryptocurrency around the time of CBN’s ban. The ban made it National news and this caught people’s attention.

“Everyone was asking about it but there was still some skepticism because of the ban. So, we started to actively educate people about cryptocurrency and help them understand how it can be used for their benefit.”

Despite the CBN directive severing ties between the cryptocurrency exchanges and Nigerian commercial banks, NairaEx is one of the exchanges still in operation within Nigeria.

There were reports the clampdown will force crypto exchanges out of the country, but Ajala douse the possibility of exiting Nigeria, stating “20% of our team members working remotely from different parts of the world. However, our operation is fully in Nigeria.”

NairaEx has recorded over 130,000 users, and 900,000 plus transactions since it was founded in 2015. It compete in same market with Patricia, Paxful, Quidax, Binance and Buycoins.

Choosing to remain operational in Nigeria means NairaEx has to accommodate government’s stringent regulation. Commenting on this, Ajala explained that, “Regulations always have huge effects on markets. In the case of the cryptocurrency market in Nigeria, it was no different.

“It slowed the growth of the market momentarily and affected trades for a few months but thanks to Peer-to-peer transactions we were able to weather the storm just okay. The market has recovered and thankfully we may be seeing another bull Cycle soon.”

The digital currency expert said there’s no ongoing discussion with the CBN, but hope the government will embrace bitcoin like El Salvador did when it made the crypto asset it’s legal tender.

“No, we are currently not involved in any talks and we cannot comment on what the CBN actions will be. However, they have shown interest in digital currency and that seems like a promising sign. Hopefully one day we become like El Salvador and bitcoin becomes legal tender.” Ajala said.

Follow Us