The Manufacturers Association of Nigeria, the Lagos Chamber of Commerce and Industry, and the Nigerian-American Chamber of Commerce, have reacted to the hiking of the monetary policy rate by the Central Bank of Nigeria.

They disclosed that the policy will hurt the Nigerian economy.

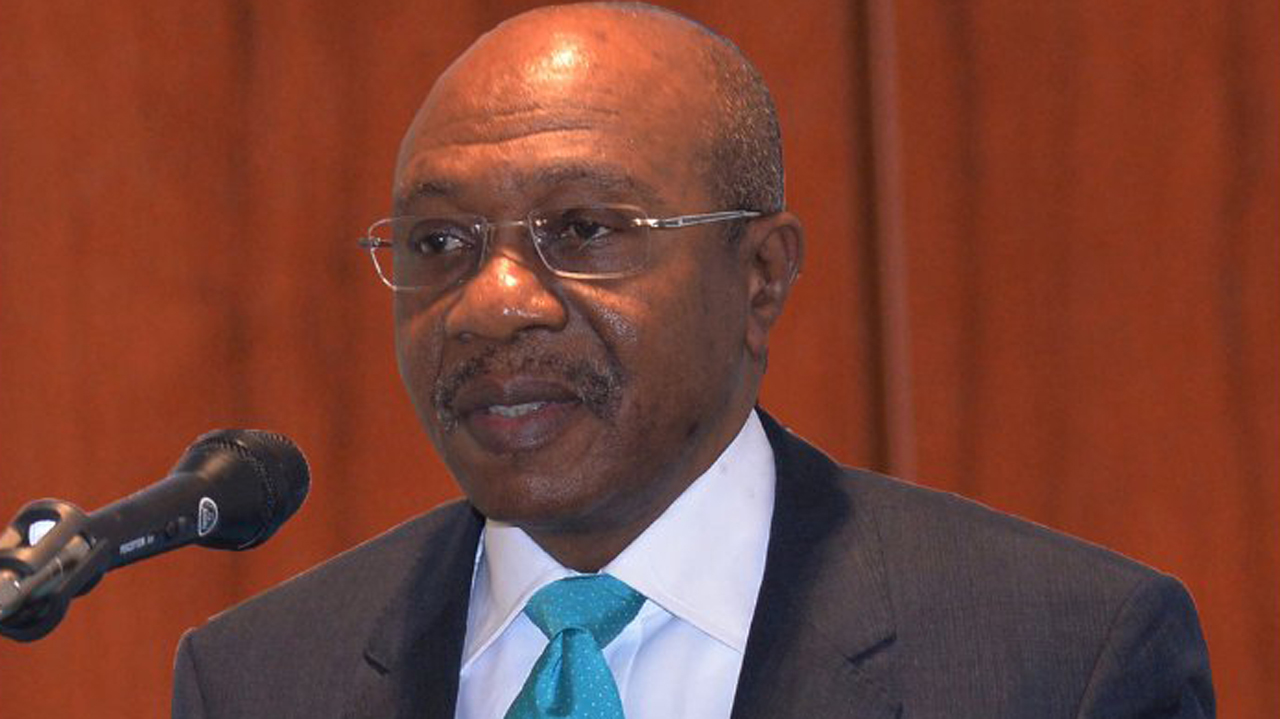

Join our WhatsApp ChannelThe CBN Governor, Godwin Emefiele, after the third Monetary Policy Committee, MPC, meeting of 2022 on Tuesday, noted that the committee backed the raising of the benchmark interest rate from 11.5 per cent to 13.5 per cent.

Prime Busines Africa reported that it was the first time the apex bank is raising the interest rate in two years, having pursued an expansionary monetary policy in the last 24 months.

Reacting to the development, President of the MAN, Mansur Ahmed, told The Punch that the move would compound the plight of manufacturers, especially the small-scale segment of the productive sector.

Ahmed said, “Commercial loans are already beyond the reach of manufacturers, especially the small and medium manufacturers. The continuous rising in food prices is worrisome. Then, exchange rate continues to go up. Where are we going as a country? The CBN leadership will have to do something about it.”

He was, however, aware that the continuous rising of inflation locally and internationally had necessitated the move, noting that it was unfortunate that Nigeria was not reaping the gains of high oil prices in the current oil boom.

On his part, Deputy President of the LCCI, Gabriel Idahosa, described the development as an inevitability, considering the recent upward inflationary trend.

“It was actually expected because inflation has gone up to 16 per cent. The CBN target is 13 per cent, so we have lost the downward trending inflation rate that has been on for quite a number of months. By last week, the financial community expected the CBN to increase the interest rate, starting with the one just announced. It was predictable.”

He said the lending rate increase would give rise to more hardship due to the higher cost of borrowing that would apply to all sectors of the economy.

“It means more hardship. It means higher cost of borrowing,” he noted, saying that all sectors of the economy would now feel the pinch.

Similarly, the Director-General of the Nigerian-American Chamber of Commerce, Sola Obadimu, condemned the decision by the CBN. He further stated that indiscriminate increase of lending rate by the CBN would inevitably drive up the cost of doing business.

He said, “There is no way you can effectively operate business at such rates. All these things have been talked about a million times by the private sector because realistically, you can’t get loans at the bank at the rate (13 per cent). It’s just another input in the range of factors that affect the cost of doing business.”

He said the government had continuously shown apathy to the plight of the private sector through unyielding taxation and several other policies.

“I think industry and enterprise are generally being killed gradually. If you’re an employer of labour, government is indirectly telling you, who asked you to employ people? There is no effort at all to support the growth of businesses. There is multiplicity of taxes by various agencies of government. Some private sector operators are determined to stay in business, some are winding up, some are relocating. That trend will continue. It’s complete apathy to private enterprise.”

Director of Trade, Investment and Programmes at the Nigerian-British Chamber of Commerce, Ine Wiche, also faulted the decision of the CBN, describing the interest rate hike as ill-timed and a step in the wrong direction.

“We don’t need that now. Everybody is crying that things are getting more expensive. We don’t need any further increments now. I don’t think it’s a good move. It’s a step in the wrong direction.”

On his part, the former President of the National Association of Small Scale Industrialists , Segun Kuti-George, said the decision was inevitable with increased inflation across the world.

He, however, noted that the interest rate hike would raise cost of production, reduce SMEs’ capacity to employ and the purchasing power of consumers.

“Cost of funds will rise; production costs will increase and unemployment will also rise. People may not be able to afford what is offered for sale,” he said.

Follow Us