By Mike Olafusi

Join our WhatsApp ChannelBusinesses can be run on cash basis or accrual basis but most business owners don’t know this and end up doing cash basis as that is what comes intuitively to every non-accountant.

Cash basis is when transactions are recorded only when cash is exchanged. It is the more convenient way of keeping financial records for most business owners who have no accounting knowledge – they easily log into their bank account and go through their bank statements to piece together how their business is doing and what the plan for the next months or year should be.

Accrual basis involves recognising transactions when the value (and not necessarily cash) has been exchanged and for the period the value covers. Revenue is recognised when the service is rendered or product is delivered and not when the payment comes in. Expense is incurred when you get the value and not when you made the payment. Accrual basis is the better way of running a business as it correctly captures what is happening in the business financially and provides the right foundation for forecasting. In fact, when getting a loan from a bank it is an accrual based financial transactions record they want to see and not a cash based financial transactions record.

When a business owner pays for two years rent, accrual basis requires recording just one year rent value in his expenses for that year while cash basis involves recording the entire paid cash amount as expenses. Two questions will immediately arise in the mind of most people – 1) what does accrual basis do with the remaining one year rent amount? 2) what is wrong about recording the two years rent as expenses in the current year?

Accrual basis has special ways of capturing the excess or shortage of cash for the recognised transactions. For the two years rent example, you are not allowed to capture the two years rent as expense in just the current year as that means you will end up capturing no rent expense for the next year. Rather, you will capture just one year value as rent expense in the current year and put the remaining one year value as a prepayment (you can think of it as an asset to be used next year). What is wrong about capturing the two years rent as an expense in the current year is that it ignores the fact that the rent is for two years and creates a problem for business forecasting. Cash basis of running business creates an unnatural cycle in the business financial records – there will be years of worryingly high expenses and low revenue followed by years of very low expenses and high revenue. And all these won’t be because the business experienced any operational or significant change, but because customers are not paying you immediately.

READ ALSO: Prime Business Africa’s SEEDS 5 Set To Address AfCFTA Opportunities For Startups

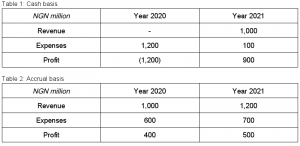

Every business owner needs to get familiar with the accrual basis and let go of the cash basis when examining their business and making plans for the future. Below are two tables showing cash basis and accrual basis for TTT Limited, an engineering company that builds production plants for large manufacturing companies, and gets paid 45 days after project delivery considering that each project takes just under a year to complete. The company stocks two years supplies, gets new projects at year start, completes the projects by December and gets payment in February of the following year.

Notice that the cash basis one captured no revenue for year 1 and recorded the two years supplies in alongside other expenses in year 1, while year 2 looked like a miracle year of big revenue and little expenses. Those are the type of confusion it passes on to any forecasting done based on it and to external stakeholders interested in funding or partnering with the business. Ultimately, it makes the business look unrealistic to all external parties – even the tax authorities would not allow you to use the cash basis when filing for your tax.

Follow Us