Let’s be honest, loan apps can be a real lifesaver. It’s safe to say that loan apps have been saving lives since they became quite popular among Nigerians, providing “urgent 2ks” with quite affordable interest rates and a seamless registration process.

But then, this supposed blessing can sometimes be a curse, especially when the debt repayment is not properly met as when due. This ‘curse’ can be in the form of harassment, embarrassment, and even obstruction of proper phone usage with recurring messages, calls, and threats. This has led to many clamouring for the ban of these loan apps.

Join our WhatsApp ChannelHowever, we can’t deny these loan apps’ usefulness. The Federal Competition and Consumer Protection Commission (FCCPC) also sees this and repeatedly states it cannot ban loan apps.

Despite these challenges, some loan apps continue to operate legally and abide strictly by the ethical standards guiding their operations as stipulated by the necessary regulatory bodies, such as the FCCPC and the industry Joint Task Force, which comprises the Nigerian Communications Commission (NCC), the Central Bank of Nigeria (CBN), and the Economic and Financial Crimes Commission (EFCC), among others.

These law-abiding loan apps have garnered some positive reviews for themselves from users, which can be found on the Apple Store and Google Play Store. If you’ve been contemplating getting an urgent loan from these apps, then you will most definitely be concerned about the apps with higher ratings to prove their credibility.

We’ve gone through the stress of helping you compile a list of the 10 loan apps in Nigeria with average to high user ratings as of December 2024 to guide your decision. These user ratings were culled from the Google Play Store since more loan apps are available there than in the Apple Store.

Top 10 Loan Apps in Nigeria as of December 2024 By User Ratings

These loan apps have adequate user ratings as well as fair interest rates, which have earned them high downloads among users in Nigeria. See the top 10 loan apps in Nigeria by user ratings as of December 2024:

- QuickCheck

QuickCheck is a digital loan app that uses machine learning to predict the borrower’s behaviour and instantly evaluate loan applications.

You can get loans from ₦1,500-₦500,000 with terms from 91 days to 1 year.

As of December 2024, here are the user ratings from the 205,000 people who have reviewed the app:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.5 | 1M+ | 5% |

- Branch

This is also a loan app that offers loans from ₦6,000 to ₦1,000,000 or a period of 4–52 weeks. Although the interest rates vary due to factors such as your repayment history and the cost of lending, here are the user ratings and other important information:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.4 | 10M+ | 17%–40% |

Note: Branch is only available on the Google Play Store.

READ ALSO: Why Tinubu’s 2025 Budget Projections Are Unrealistic — Analysts

- FairMoney

FairMoney is a loan app that doubles as a microfinance bank and offers banking, savings, and investment services.

The app gives quick loans of up to ₦3,000,000 with repayment periods from 61 days to 18 months in five minutes with no collaterals & easy repayment terms.

Here are the user ratings from the 749,000 people who have reviewed the app on the Google Play Store:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.4 | 10M+ | 2.5% to 30% |

Note: FairMoney is also available on the Apple Store.

- Okash

This loan app is managed by Blue Ridge Microfinance Bank Limited. You can get loans from ₦3,000-₦500,000, with the repayment plan ranging from 91 days to 365 days. The app is available on the Google Play Store.

See the user ratings below:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.4 | 10M+ | 0.1% -1% daily |

- Palmcredit

This is a loan app in Nigeria owned by Newedge Finance Limited. Palmcredit is a trusted loan app that offers loans that range from ₦2,500 to ₦100,000 with loan term durations of 12-26 weeks. The app is available on the Google Play Store and Apple Store.

Here are the user ratings from the Google Play Store, along with other vital information about the app:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.2 | 10M+ | 8% |

- Carbon Loan App

Carbon is a CBN-licensed digital bank that gives you access to instant loans, Digital Ajo, and savings, among others. The app is available on the Apple Store and Google Play Store.

The ratings on the Google Play Store are:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.1 | 5M+ | 4-30% |

- Renmoney

Renmoney grants both personal and micro-business loans ranging from ₦50,000 to ₦6 million. The app is available on the Google Play Store and Apple Store.

Here are the user ratings as of December 2024:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.1 | 1M+ | 2.49% |

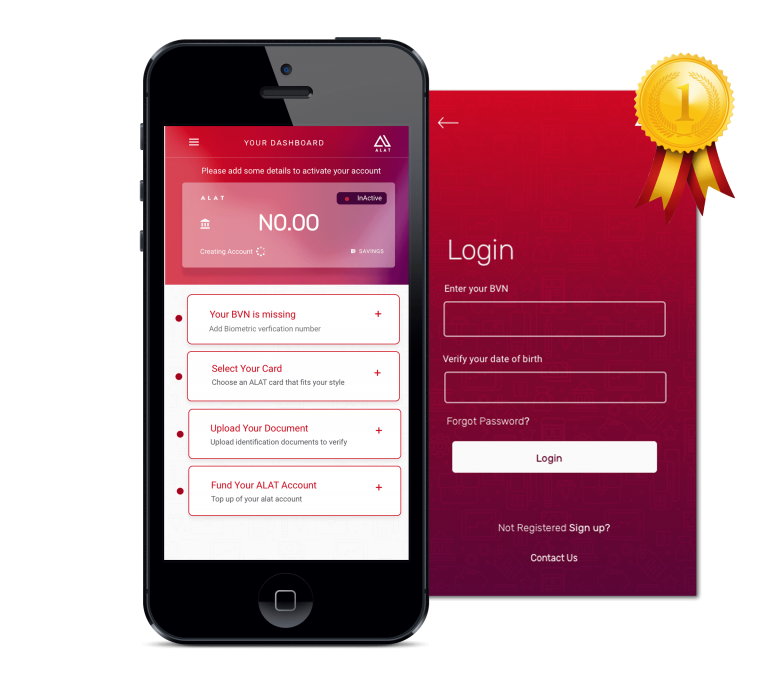

- ALAT by Wema

This is a loan app owned by Wema Bank that allows you to transfer money and also borrow loans.

The user ratings as of December 2024 are:

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 4.0 | 1M+ | 2% |

- Umba

This loan app allows its users to apply for loans, drawdown, and repay loans ranging from ₦2,000 to ₦30,000 directly from their smartphone or desktop computer. The repayment time is 62 days.

The app is available on the Apple and Google Play Store.

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 3.8 | 1M+ | 10%–21% |

- KiaKia

KiaKia offers loans for personal use and small and medium-sized (SME) business owners. The app is available for download on the Apple Store and Google Play Store

| User Ratings | Number of Downloads | Interest Rate (varies based on loan amount) |

| 3.5 | 10K+ | 5.6% |

Conclusion

These loan apps are great options when considering where to borrow from.

Remember to review the terms of your selected app carefully and always borrow responsibly to avoid unnecessary stress.

Elsie Udoh is an SEO content writer who specialises in writing engaging stories that resonates with diverse audiences. She studied mass communication at the Lagos State University.

Follow Us