Nigeria’s Foreign Reserves Surge Amid Deepening Hardship

In recent months, Nigeria’s foreign reserves have seen a substantial rise, hitting $40.2 billion in October 2024, up from $38.4 billion in September. This increase, lauded by the government as a sign of economic recovery, contrasts with the daily struggles faced by many Nigerians. While the numbers present an optimistic outlook on paper, for the average Nigerian, life has only gotten harder.

At an investors’ meeting in Washington DC, Olayemi Cardoso, the Governor of the Central Bank of Nigeria (CBN), alongside Wale Edun, Nigeria’s finance minister, celebrated this upward trend in foreign reserves. According to Edun, the reserves are “building organically” due to the government’s shift away from defending the naira, a costly policy that previously drained billions in efforts to maintain the currency’s value.

Join our WhatsApp ChannelHowever, the story behind these figures paints a more complex picture, one that raises questions about who really benefits from these growing reserves and what the long-term implications are for Nigerians facing economic hardship.

“Our Reserves Are Growing, But We’re Suffering”

In the bustling streets of Lagos, Nigerians are far from celebrating the news. For people like Ifeanyi Okonkwo, a shop owner in the city’s markets, the surge in reserves feels irrelevant.

“They say our foreign reserves are growing, but we’re suffering every day,” Okonkwo lamented. “Prices keep rising. I can barely afford to feed my family, and they are talking about billions in reserves.”

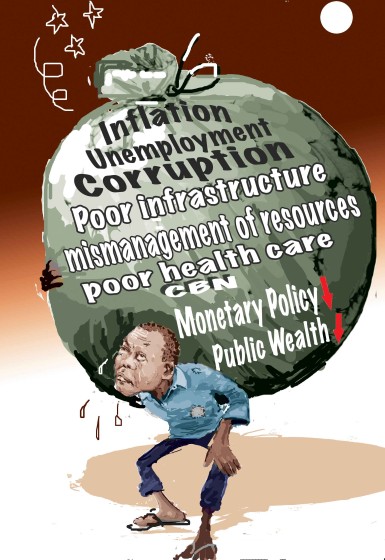

His sentiment echoes across the nation. Food prices have skyrocketed, fuel shortages persist, and inflation is eating away at incomes. The government’s shift towards letting the market determine the naira’s value may have stabilised the foreign reserves, but it has also led to a sharp depreciation of the naira, which has made everyday goods unaffordable for many.

The Cost of Economic Policies

Wale Edun defended the government’s policy changes, emphasising that past strategies to defend the naira were unsustainable. “A billion dollars every month just to defend the naira,” he stated at the meeting, pointing out that those policies had been costly and ultimately ineffective.

“We’re trying as much as possible to improve our supply organically, without the central bank having to put in money all the time,” Edun said. He emphasised that the government’s goal is to stabilise the naira organically, rather than through constant intervention.

Yet, these policy shifts seem to come at the expense of ordinary citizens. By allowing the market to set the naira’s exchange rate, the government has reduced its spending on propping up the currency, but the depreciation has meant that imports, which Nigeria heavily relies on, have become more expensive. As a result, many Nigerians are left to bear the brunt of these economic adjustments.

READ ALSO: Nigeria’s Foreign Reserves Reach $40.2b Amid Shift In Economic Policy

“The market might be setting the naira’s rate, but it’s us who pay the price,” Okonkwo added, his frustration palpable. “They don’t understand the impact this has on people like me.”

Who Benefits from Rising Reserves?

As foreign reserves increase, the Nigerian government has tried to position itself as a stable investment environment. Edun pointed to the boost in foreign portfolio investment (FPI) and the positive response from investors in the wake of these policy changes.

“We’ve seen good response from investors through the FPI,” Edun noted. “There’s improved confidence for people who want to put in a lot more resources.”

This surge in investor confidence is indeed a positive development for Nigeria’s financial stability, but it raises the question: Who really benefits from these improvements? While foreign investors may be seeing lucrative returns, millions of Nigerians continue to grapple with rising costs and stagnant wages.

“What good are foreign reserves if we can’t afford to live?” asked Maryam Sule, a teacher in Abuja. “They talk about billions of dollars, but I can’t even afford basic groceries anymore.”

A Disconnect Between Policy and Reality

The Nigerian government’s focus on macroeconomic indicators like foreign reserves and investor confidence highlights a growing disconnect between policy decisions and the reality of everyday life for its citizens. While rising reserves are a crucial buffer for the country’s economy, especially in times of global uncertainty, they do little to address the immediate needs of a population struggling to make ends meet.

Analysts have warned that without policies to cushion the effects of a weakening naira and rising inflation, the benefits of growing foreign reserves will remain abstract to most Nigerians. Moreover, the government’s strategy of letting the market set the exchange rate has created a volatile environment where the naira’s value can fluctuate dramatically, impacting the prices of essential goods.

Bridging the Gap Between Policy and People

The question now is how Nigeria’s policymakers will address the widening gap between the growth in foreign reserves and the suffering of its people. While foreign reserves provide a safety net for the country, they must be coupled with policies that directly alleviate the pressures felt by ordinary Nigerians.

“We need more than just talk about foreign reserves,” said Sule. “We need real solutions that help us survive today, not promises about the future.”

Finally, while the rise in Nigeria’s foreign reserves offers some economic optimism, it is essential that the government recognise the hardship facing millions of its citizens. As the country looks to stabilise its economy, it must also prioritise policies that address the immediate needs of its people, or risk deepening the discontent that many Nigerians feel toward their leaders.