There are concerns that the latest hike in pump price of Premium Motor Spirit (PMS) also known as petrol would further aggravate the cost of living crisis in Nigeria.

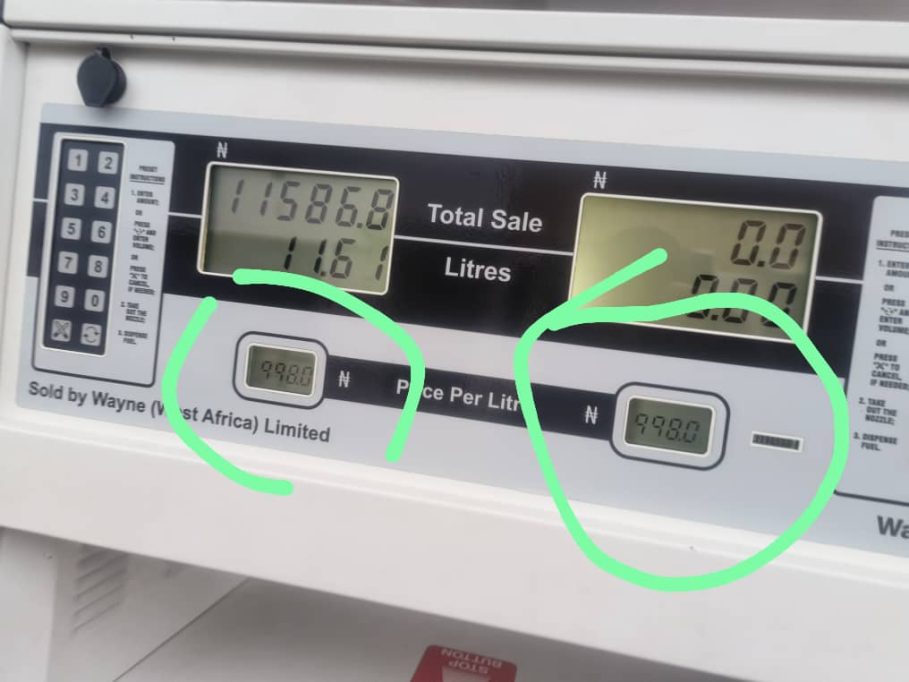

Nigerians woke up on Wednesday, 9th October 2024 to the shocking news of the hike in price of petrol. The Nigeria National Petroleum Company Limited (NNPCL) increased petrol price in its filling stations across the country. Formerly sold around N897, the new price is now N1,030 per litre in Abuja and N998 in Lagos.

Join our WhatsApp Channel

With the new price hike, other states in South-South, South-east and northern part of the country are expected to experience higher prices given the cost of logistics.

Independent marketers may sell above N1,100 in Lagos and more in other parts of the country.

READ ALSO: Breaking: NNPCL Fuel Pump Price Set For ₦1000

Reacting to the development, the Independent Petroleum Marketers Association of Nigeria (IPMAN), said the latest petrol price adjustment heralds full deregulation of the downstream petroleum market in the country.

The IPMAN President, Abubakar Garima, who appeared on Channels Television Sunrise Daily on Thursday, said the price adjustment was due to removal of extra costs that was hitherto undertaken by the NNPC as a form of subsidy. He described it as the “removal of subsidy deregulation,” adding that “Now, deregulation has started taking place fully.”

Nigerians have grappled with series of petrol price hike in the last 18 months. Petrol pump price jumped by over 400 per cent from N198 to N1,030 per litre since President Bola Tinubu’s “subsidy is gone” pronouncement on 29 May 2023. Following the announcement of petrol subsidy removal by the president during his inaugural speech, petrol which was sold at N198 per litre jumped to about N540 and subsequently increased to N617. The NNPCL further increased the price to about N855 early last month.

READ ALSO: Proposed VAT, Petrol Price Hike Will Deepen Cost-of-living Crisis – Atiku

The latest price hike came at a time that the NNPCL reportedly withdrew from being the sole off-taker of Dangote Refinery petrol. At the commencement of supply of petrol from the 650,000 barrels per day refining facility, the national oil company became the sole distributor of refined petrol while diesel was thrown open to marketers. However, following pressures from independent marketers and even lawmakers at the National Assembly, who described the arrangement as unfair, the NNPCL rescinded its decision about three weeks after.

Many Nigerians had hoped that with the commencement of local refining of petroleum products by the Dangote Refinery, prices of the products will drop significantly. However, many are now expressing disappointment over the recent development with regard to increase in price.

According to an energy economist, Engr Mustapha Samaila Ingawa, the withdrawal of NNPCL as sole off-taker of Dangote Refinery petrol would lead to increase in price because the price differentials paid by the national oil company as subsidy will no longer be there.

“What that means is that if there is any element of subsidy in the previous pump price, it will no longer be there,” Ingawa stated.

On the argument that full deregulation has a positive outcome, the IPMAN president said it will lead to availability as many marketers will now have the product. “The NNPC is no longer the sole importer. Other marketers too will participate. It is the same thing in buying the product. Other marketers will buy products directly from Dangote. It is not only NNPC,” Garima said.

Engr Ingawa explained that the competition that will ensue as a result of many marketers having direct access to Dangote petrol is to the extent that none will have the opportunity to reap off consumers in any part of the country when they all get the product at the same amount. He however, , pointed out that there is a limit to which Dangote Refinery can go in terms of lowering the cost because it is a business and must make profit for sustainability. “There is a particular price threshold that you cannot go lower than that. Even if marketers have negotiation power, it can only be to an extent. There is a particular threshold that Dangote Refinery cannot go below,” he stated.

According to the energy expert, naira-for-crude deal will help reduce pressure on the naira and over time stabilize the exchange rate because about 40 per cent of FX demand is goes to PMS imports. He said since crude oil is sold to them at equivalent dollar rate, once the pressure on naira drops, exchange rate will also drop leading to reduction in price of crude and consequently refined products.

Ingawa, who spoke on a TVC programme, observed that naira-for-crude arrangement will not be sustainable. He explained that crude oil is a global commodity traded in dollars. He stressed that while the value of the naira will appreciate due to sales of crude in the local currency, the arrangement will however obstruct global crude supply and Nigeria will also loses some revenues in dollars.

Prime Business Africa understands that the implementation of the naira-for-crude policy which according to the minister of finance, commenced on October 1, will end in six months time.

Petrol Price Hike Impact on cost of Living

The latest price hike will no doubt have a spillover effect on costs of things including food, transport, and business operations among others, adding to the existing economic hardship in the country.

Inflation rate has been on an upward spiral reaching a peak of 34.19 per cent in June and dropped in July and August, now at 32.15 per cent.

Analysts have expressed fears that further hike in price of petrol would reverse the inflation trajectory which they said is now on downward trend.

Commenting on the fuel price increase, Chief Economist and Partner at SPM Professionals, Dr Paul Alaje, drew parallels between fuel prices and exchange rate, adding that Nigerians should expect nothing different when the authorities decided to float the currency which led to devaluation. “You cannot float the currency of an import-dependent, low productive nation and expect all to be well with living standards,” Alaje wrote on X while responding to a financial expert, Kalu Aja, who is in favour of devaluation.

Alaje who countered Aja saying that floatation is a wrong economic prescription for Nigeria, made a case for pegging the exchange rate to manage the cost of living crisis in the country .

He said: “We can adopt several models to determine the price. Price determination is not only done with market forces. Recent research showed that it will be around 1050 to 1200 naira to one dollar.

“First, you need a minimum of one year’s import bill to peg. We already have $38 billion according to the authorities. We can save an additional $20 billion from oil theft. If you are able to achieve this, you will conveniently peg the currency.”

He made reference to developed countries like Germany, Russia, and Japan that adopted pegging over the years to manage their economy, adding that countries like Argentina, Venezuela, and Zimbabwe who refused to do so have suffered the consequences.

The economic expert further noted that the real problems Nigeria needs to solve include: improving productivity, stopping oil theft, improving export, boosting power consumption (especially industrial use), providing security in farms and the entire country , and halting the rush to take foreign loans among others.

Victor Ezeja is a passionate journalist with six years of experience writing on economy, politics and energy. He holds a Masters degree in Mass Communication.

Follow Us