Investor Optimism Pushes Equity Market Higher

Nigeria’s equity market on Monday surprised many investors as it rose by 0.19%, defying earlier predictions of a downturn.

This unexpected rise, driven by increased interest in dividend-paying stocks, saw the market add N107 billion in value. Analysts had forecasted a more muted performance for the week, largely due to the upcoming Treasury Bills auction, which was expected to shift investor attention toward the fixed-income market.

Join our WhatsApp Channel“The equity market’s performance caught many off guard,” said John Adewale, an investment analyst in Lagos. “Stocks like Fidelity Bank, Ellah Lakes, and Livestock Feeds really boosted the market, particularly as dividend announcements tend to attract significant investor interest.”

Key Players in the Equity Market Surge

Fidelity Bank, which announced an interim dividend of 85 kobo per share, saw its stock climb from N13 to N14.30—a 10% increase. Other notable performers included Livestock Feeds, which rose by 9.76%, and Ellah Lakes, which climbed by 8.44%. These gains helped drive the market’s positive close, despite the cautious outlook shared by some market observers earlier in the day.

“I think what we’re seeing here is that dividend-paying stocks continue to provide investors with some confidence,” Adewale added. “People are willing to invest when they see potential returns, even when broader market conditions are uncertain.”

Equity Market Defies Expectations

Analysts at Meristem Research had initially expected the NGX All-Share Index (ASI) to decline this week, citing a lack of strong market catalysts. “We anticipated muted trading volumes and limited upside in equity prices,” said a spokesperson from Meristem. “But clearly, investor interest in high-performing dividend stocks outpaced the market trends we were watching.”

READ ALSO: Equity Market Declines By 0.95% As Investors Lose N539bn In Nigeria

Despite this week’s positive start, Nigeria’s equities market is still showing mixed results over the past month. The NGX performance indicator has decreased by 0.86% in October so far, although it has increased by 30.67% year-to-date.

Analysts’ Take on Future Equity Market Performance

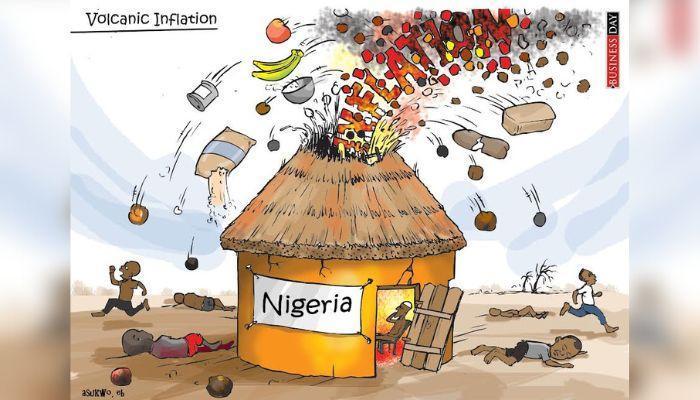

Looking ahead, market analysts remain cautious, predicting that mixed sentiments will persist in the equity market. “We expect the current inflationary environment and the recent hike by the Monetary Policy Committee (MPC) to play a role in shaping market activity,” said United Capital Research in a recent note. “Investors will likely take a more cautious approach, focusing on equities with strong fundamentals and sustainable profitability.”

The report from United Capital also highlighted that corporates with pending corporate actions, like dividends or earnings reports, would likely outperform the market. “Fund managers may start improving their cash positions to take advantage of market volatilities while maintaining a long-term investment approach,” the note added.

Dividend Stocks Outperform as Equity Market Remains Volatile

Despite the volatility, stocks like Tantalizer, UBA, Access Holdings, Caverton, and GTCO were among the most traded on the Lagos Bourse. Monday saw over 1.3 billion shares worth N5.96 billion traded in 10,424 deals.

Chidi Okoro, a stock trader, remarked, “It’s clear that even in times of uncertainty, dividend stocks provide a level of security for investors. We’re seeing a lot of activity centered around these stocks as investors position themselves for future returns.”

Cautious Optimism for Equity Market

While Monday’s rise in the equity market may have defied expectations, analysts remain cautious about the future. Inflationary pressures and interest rate hikes continue to weigh on the broader economic landscape. However, as dividend-paying stocks and other solid performers continue to attract investor interest, opportunities remain for those willing to take a strategic approach to trading.

As Okoro noted, “The equity market is unpredictable, but those who pay attention to the right stocks can still find opportunities for growth.”

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.