FG Announces VAT Exemption for Diesel, LNG, CNG, and Electric Vehicles

The Federal Government has introduced a new value added tax (VAT) exemption on energy products, including diesel, Liquefied Natural Gas (LNG), Compressed Natural Gas (CNG), and electric vehicles. This move is aimed at reducing energy costs and supporting the nation’s transition to cleaner energy sources.

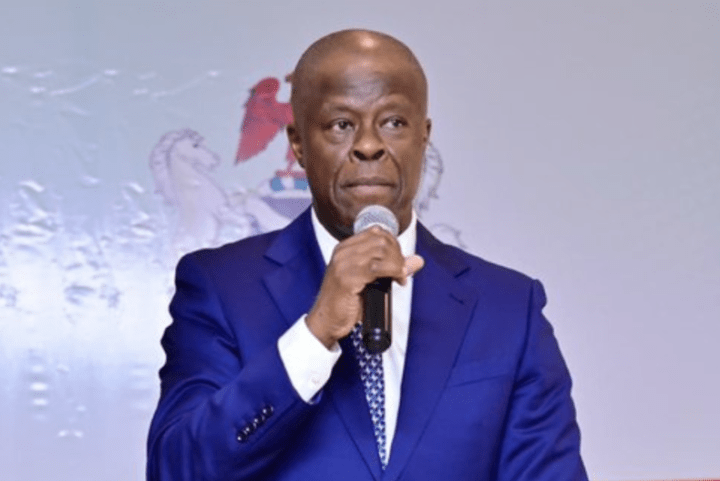

Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, announced the VAT exemptions in a statement released on Wednesday. According to Edun, these tax breaks are part of broader economic measures aimed at addressing the rising cost of living and promoting energy security.

Join our WhatsApp ChannelNew Tax Policies to Reduce Energy Costs

Edun explained that the VAT Modification Order 2024 will grant tax relief on diesel, LPG, CNG, and LNG infrastructure, as well as on electric vehicles and clean cooking equipment.

“These measures are designed to lower the cost of living, bolster energy security, and accelerate Nigeria’s transition to cleaner energy sources,” he said in the official statement.

The government’s decision to exempt VAT on these energy products is seen as a significant step toward mitigating the impact of high energy costs on the economy and citizens. It is also part of Nigeria’s broader push to adopt cleaner, more sustainable energy solutions.

Tax Incentives for Offshore Oil and Gas Production

In addition to the VAT exemptions on energy products, Edun also revealed new tax incentives for deep offshore oil and gas operations. The Oil & Gas Companies (Tax Incentives, Exemption, Remission, etc.) Order 2024 provides tax reliefs specifically targeting deep offshore oil projects.

“The Notice of Tax Incentives for Deep Offshore Oil & Gas Production provides new tax reliefs for deep offshore projects,” Edun said. “This initiative is aimed at positioning Nigeria’s deep offshore basin as a premier destination for global oil and gas investments.”

READ ALSO: Proposed VAT, Petrol Price Hike Will Deepen Cost-of-living Crisis – Atiku

He emphasised that these reforms are part of a broader series of investment-focused initiatives being driven by President Bola Tinubu’s administration. “They reflect the administration’s strong commitment to fostering sustainable growth in the energy sector and enhancing Nigeria’s global competitiveness in oil and gas production.”

FG’s Broader Tax Reform Agenda

The VAT exemptions and offshore tax incentives are part of a larger tax reform initiative launched by President Bola Tinubu. In August 2023, Tinubu established a tax and fiscal policy committee, led by renowned tax expert Taiwo Oyedele, to develop a new tax framework for Nigeria.

The committee has since proposed several reforms aimed at driving economic growth, including raising the VAT rate and introducing tax exemptions for low-income earners.

“These reforms are necessary to ensure that Nigeria remains competitive in the global market while also supporting local industries and consumers,” Edun added.

Impact on the Economy and Energy Transition

The VAT exemptions on energy products are expected to have a significant impact on reducing costs for businesses and households alike. Diesel, in particular, has been a major driver of transportation and energy costs in Nigeria. By exempting VAT on diesel and other energy products, the government aims to reduce the financial burden on citizens.

The introduction of incentives for electric vehicles and clean energy infrastructure aligns with Nigeria’s long-term goal of reducing its dependence on fossil fuels and embracing renewable energy solutions.

“The government’s decision to exempt VAT on electric vehicles and clean cooking equipment signals its commitment to reducing greenhouse gas emissions and improving the environment,” an energy expert commented.

The measures are expected to also attract foreign investment, particularly in Nigeria’s deep offshore oil and gas sector, which is seen as a vital area for future growth.

Looking Ahead

As Nigeria moves toward implementing these tax exemptions and incentives, experts are hopeful that the policies will lead to lower energy prices, increased energy security, and a faster transition to cleaner energy.

“The VAT exemptions on diesel, LNG, and electric vehicles will go a long way in making energy more affordable for everyday Nigerians,” said a Lagos-based economist. “It’s a step in the right direction, especially for a country that is grappling with inflation and high living costs.”

While the road ahead remains challenging, the Federal Government’s efforts to revamp the tax system and promote clean energy signal a positive shift in policy that could benefit both the economy and the environment.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

Follow Us