Economic experts have faulted the continuous increase of the Monetary Policy rate (MPR) also known as benchmark interest rate, by the Central Bank of Nigeria (CBN), saying it won’t solve the problem of inflation in the country.

According to them, inflation is mainly caused by issues with supply deficit not as a result of demand.

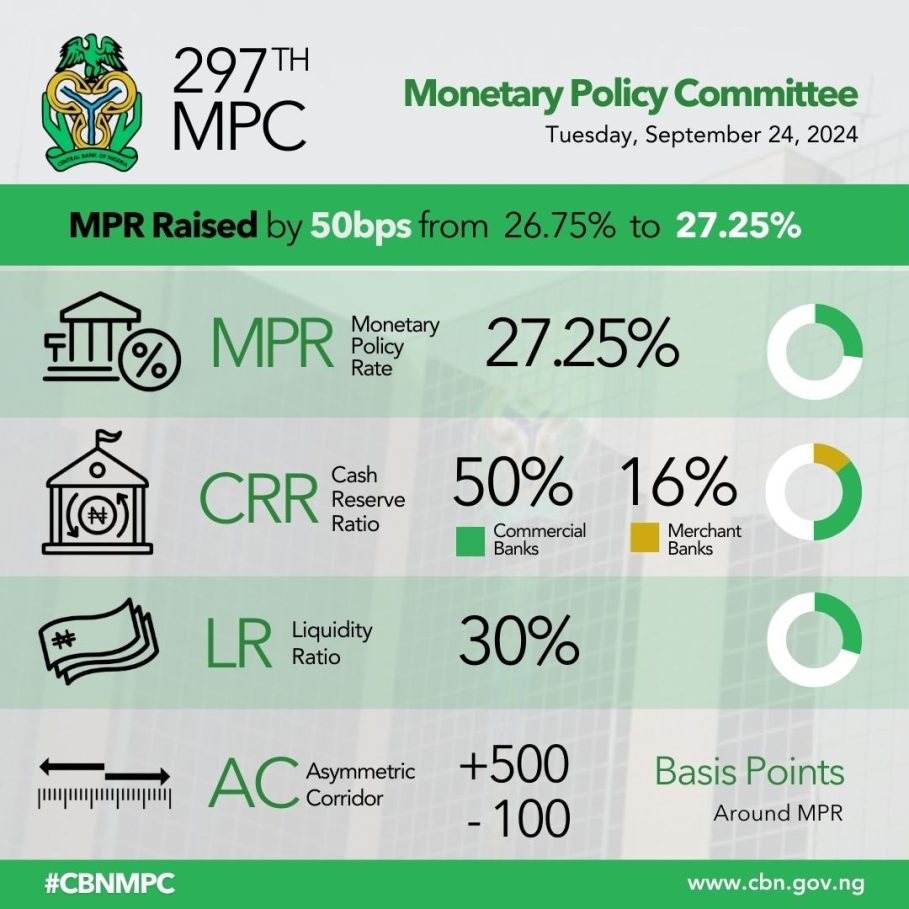

Join our WhatsApp ChannelThe CBN governor, Dr Olayemi Cardoso, while briefing newsmen at the end of the 297th Monetary Policy Committee (MPC) meeting in Abuja on Tuesday, 24 September, announced that the apex bank has further raised the MPR by 50 basis points from 26.75 per cent to 27.25 per cent.

The bank also raised Cash Reserve Ratio (CRR) by 50 basis points from 45 per cent to 50 per cent for Deposit Money Banks (DMBs) and from 14 per cent to 16 per cent for Merchant Banks.

Cardoso said the bank retained liquidity Ratio (LR) at 30 per cent and Asymmetric Corridor still +500/-100 basis points around the MPR.

This is the fifth consecutive time the CBN has raised the MPR this year as it pushes to bring down the inflation rate. The assumption of the monetary authority is that increasing interest rate would reduce borrowing and also help in tightening money supply to the economy.

However, the experts believe that Nigeria’s inflation is not a demand pull but caused by supply chain disruptions.

READ ALSO: CBN Further Raises Benchmark Interest Rate To 27.25%

According to the Consumer Price Index reports by the National Bureau of Statistics (NBS), Nigeria’s headline inflation which had reached a 28-year high of 34.19 per cent in June dropped to 33.40 per cent in July and 32.15 per cent in August 2024.

Financial analyst and educator, Kalu Aja, while reacting to news of the latest MPR hike said: “Raising rates won’t solve supply chain issues that cause food prices to rise.”

Mr Aja insisted that what the country needs is to tackle issues related to supply to be able to effectively address high prices of goods and services.

Some analysts said that having recorded deceleration of the inflation rate for two consecutive times, the CBN should have retained the previous interest rate, while exploring other policy measures to ease prices of things.

The CBN in its communiqué issued and signed by Cardoso, observed that the recent drop in headline inflation rate was mainly driven by decline in food inflation, as core inflation rose marginally to 27.58 per cent in August 2024, compared with 27.47 per cent in July.

READ ALSO: Nigeria’s Inflation Rate Further Drops To 32.15%

On his part, Chief Economist and Partner at SPM Professionals, Dr Paul Alaje, said the real problem is high exchange rate resulting in weak naira.

Highlighting the implication of the MPR hike, the economic expert said: “Interests on borrowed money collected from banks are expected to increase marginally.” He added that the policy will make banks to have less funds to trade with. “This is done to tame money supply,” he explained. “But, why won’t money supply be high in a high cash dependent economy with a currency that is vulnerable to devaluation?” he queried.

“The real problem here is weak Naira. Everything depends on it. The gain from tightening is often lost to devaluation,” he further observed.

Ways to Tackle Inflation

Alaje suggested four ways of dealing with the inflation problem in Nigeria which include:

“Stop deficit financing; peg the naira exchange rate; being mindful of the continuous rate hikes (as they stifle growth and employment); and reduce ways and means financing to 1 per cent.”

He further said that recent findings in economics reveal that monetary tools are not sufficient “to combat non monetary induced inflation such as acute supply side shortages in food and others.”

He noted that “policy convergence” is important in conquering challenge of price instability.

Victor Ezeja is a passionate journalist with six years of experience writing on economy, politics and energy. He holds a Masters degree in Mass Communication.

Follow Us