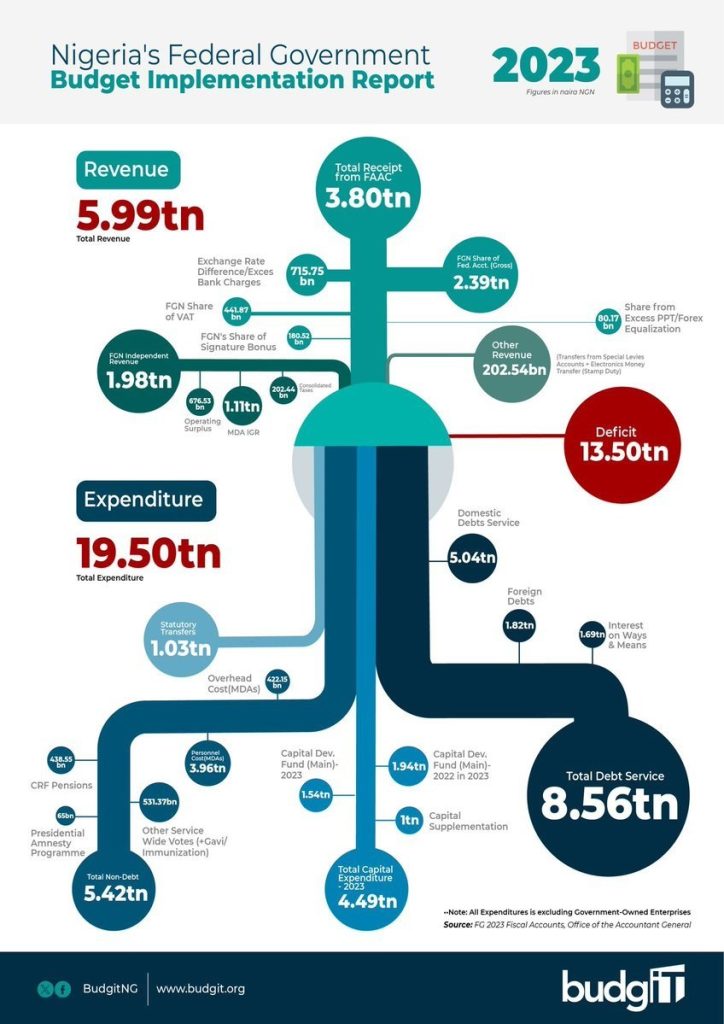

Nigeria recorded a deficit of N13.50 trillion in the 2023 fiscal year, highlighting the country’s growing financial challenges.

The Federal Government generated N5.99 trillion but spent N19.50 trillion in 2023. This means the country spent more than three times what it earned in the previous year.

Join our WhatsApp ChannelThis is according to the 2023 Fiscal Accounts Report of the Accountant General of the Federation.

The report was on the Nigerian government’s budget implementation for 2023.

READ ALSO: Nigeria Spends More On Debt Servicing Than Capital Expenditure, Personnel Costs In Q1

According to a post on X by BudgIT, a civic-tech organisation promoting transparency, accountability and effective service delivery in Nigeria, this is 225% of the total revenue.

A fiscal deficit usually occurs when what is spent surpasses the total revenue generated. This often means that the Federal Government has to borrow money to close the gap, thereby increasing debt burden.

Where The money came from

On the sources of the revenue, BudgIT said that N3.80 trillion came from the Federation Account Allocation Committee (FAAC), while the Federal Government’s share of independent revenue reached N1.98 trillion. It also revealed that the Federal Government’s share of the Federation Account contributed N2.39 trillion, “exchange rate differences was N715.75 billion, while VAT added N441.87 billion.”

How the money was spent

On how the money was spent, debt servicing accounted for 43.9 per cent of the budget at N8.56 trillion. This is considered “the largest single expense,” according to BudgIT. According to the report, non-debt spending consumed N5.42 trillion (which is 27.8 per cent), while capital expenditure was N4.49 trillion (23 per cent).

“It goes without saying that a significant portion of government spending was directed toward debt servicing, surpassing the revenue generated. As a result, the government continues to drift away from fiscal responsibility by borrowing more than it earns, resulting in a deficit of N13.50trn,” BudgIT further stated.

When compared to 2022 budget implementation report, it shows that while the total revenue increased from N5.30 trillion to N5.99 trillion (13 per cent increase in total revenue), the government’s spending on debt servicing jumped by 51.50 per cent from N5.65 trillion in 2022 to N8.56 trillion in 2023. The total expenditure in 2022 stood at N14.63 trillion, leading to a deficit of N9.30 trillion.

Of the N21.83 trillion approved budget for 2023, a total of N10.49 trillion was estimated as revenue. This indicates a decline.

Nigeria Borrows To Service Debt – Analyst

Commenting on the 2023 budget implementation report, a financial analyst and educator, Kalu Aja, said Nigeria’s total revenue cannot service its debt, forcing it to borrow to do so.

While painting a picture of the bleak financial landscape of the country, Mr Aja observed that about 90 per cent of the Federal Government’s revenue earnings only cover salaries and overhead costs. With the precarious financial situation of the country, analyst wondered why the authorities choose to spend “billions on luxury cars, homes and jets for less than 1,000 people.”