As Nigeria’s inflation rate continues to surge, high food prices has remained a major contributor to it.

The latest data released by the National Bureau of Statistics (NBS), show that the headline inflation went up to 33.95 per cent in May from 33.69 per cent recorded in April 2024 for 17th consecutive month.

Join our WhatsApp ChannelThis was mainly driven by food and non-alcoholic beverages component which was 17.59 per cent in terms of item contribution to the inflation, according to the NBS data.

Others among the top five contributors are housing, water, electricity, gas & other fuel (5.68 per cent), clothing & footwear (2.60 per cent), transport (2.21 per cent) and furnishings & household equipment & maintenance (1.71 per cent).

On a year-on-year basis, the headline inflation rate was 11.54 per cent points higher compared to the rate recorded in May 2023, which was 22.41 per cent.

However, on a month-on-month basis, the headline inflation rate slowed in May to 2.14 per cent, against 2.29 per cent recorded in April 2024.

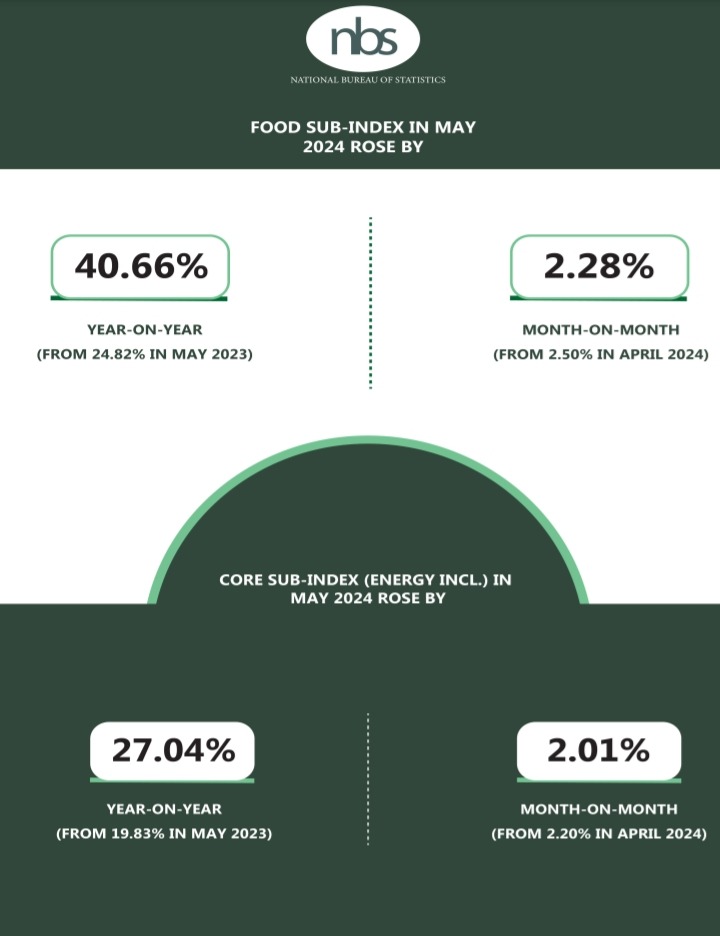

Food inflation rose by 15.84 per cent to 40.66 per cent, year-on-year when compared to the rate recorded in May 2023 (24.82 per cent).

NBS said the rise in food inflation on year-on-year basis was as a result of an increase in prices of Semovita, Oatflake, Garri, Beans, Irish Potatoes, Yam, and other tubers, Palm Oil, Vegetable Oil, Fish, Meat, Bread and Cereals.

The soaring inflation was caused by reforms of the President Bola Tinubu administration which involved removing petrol subsidy, and floating of the local currency, the Naira, in the foreign exchange market which led to more than 300 per cent devaluation.

The Central Bank, in trying to tame inflation, has hiked the benchmark interest rate three times in three months by 750 basis points to 26.25 per cent.

The CBN Governor, Dr Olayemi Cardoso, during the last Monetary Policy Committee (MPC) meeting held in May, said the apex bank would continue to maintain high interest rate in its quest to bring down inflation rate.

Economic experts have, however, argued that the monetary policy measure of raising interest rate by CBN may not solve the inflation problem without having commensurate effort from the fiscal side. They asserted that Nigeria’s inflation is not demand-push but mostly caused by supply issues.

The pressure of high prices have left millions of Nigerians grappling with the worst cost of living crisis in decades as they struggle to meet their basic needs.

The Federal Government had in April announced an increase in salaries of government workers by between 25 per cent and 35 per cent.

However, organised labour has continued to clamour for increase in national minimum wage from the current N30,000 leading to recent nationwide strike over government’s failure to meet their demands. The labour unions had proposed ₦615,000 but after series of negotiations midwifed by the Tripartite Committee on National Minimum Wage, they came down to ₦250,000. However, the government only offered to increase it to ₦62,000 which labour rejected.

While the agitation for minimum wage increase continues, there are concerns by economic experts that if the wage is raised beyond the productive capacity of the economy it might lead to further spike in inflation.

Victor Ezeja is a passionate journalist with six years of experience writing on economy, politics and energy. He holds a Masters degree in Mass Communication.

Follow Us