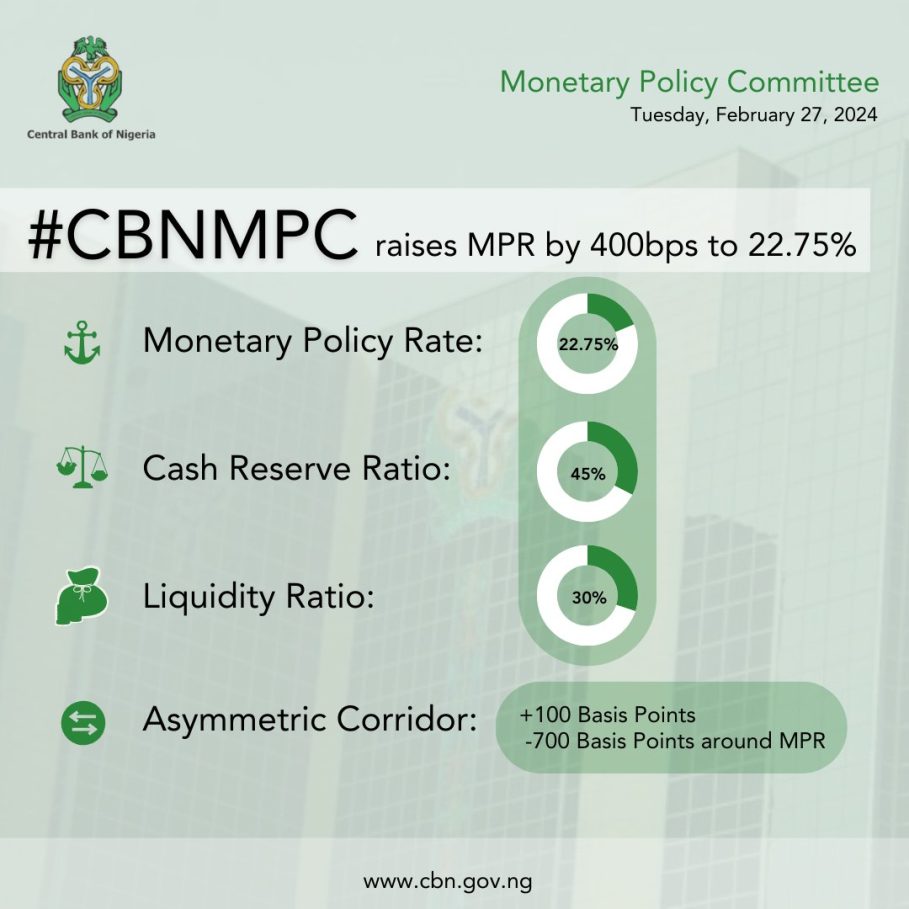

The Central Bank of Nigeria has raised the monetary policy rate (MPR) by 400 basis points to a record 22.75 per cent.

This was announced by the CBN Governor, Yemi Cardoso at a press briefing on the decisions of the 293rd Monetary Policy Committee (MPC) held on Tuesday, 27 February 2024 in Abuja.

Join our WhatsApp ChannelCardoso chaired the MPC meeting for the first time since he assumed office in September 2023.

The latest interest rate increase is the highest ever since the last MPC meeting held on the 24th and 25th of July 2023 when it was raised to 18.75 per cent.

Cardoso said the MPC voted to raise the Cash Reserve Ratio (CRR) to 45 per cent from 32.5 per cent, while the Liquidity Ratio was retained at 30 per cent.

According to the National Bureau of Statistics report, Nigeria’s headline inflation hit 29.9 per cent.

READ ALSO:

- Save Naira: CBN Sells $20,000 Forex To BDCs At Reduced Rate Of N1,301/$

- Peg Import Duty Dollar Rate At N1000/$ – CPPE Urges CBN

- CBN Issues New Guidelines For BDCs Operations In Nigeria, Bars Financing Political Activities With Dollars

Monetary policy generally, is the control of the quantity of money available in an economy and the channels by which new money is supplied. CBN’s MPR is the rate at which it lends to commercial banks. It determines many rates in the financial market as banks cannot lend below the cost of their funds. A central bank may revise the interest rates it charges to loan money to banks. As rates rise or fall, financial institutions adjust rates for their customers such as businesses. Banks, therefore, are allowed a window higher than the MPR.

The CBN governor explained that the decision to raise the MPR was informed by some economic indicators such as surging inflation, adding that the policy is clearly geared towards tightening the money supply and ensuring that there is a robust structure in place to rein in inflation.

Tackling Inflationary pressure

Cardoso said the committee discovered non-monetary factors driving inflation such as insecurity and infrastructural deficit and noted the role of fiscal policy in addressing these shortfalls while reiterating the commitment to monetary policy support.

“In this regard, the committee applauded the fiscal policy initiatives towards reducing the cost of living for ordinary Nigerians including the ongoing efforts to improve food supply, and provide mass transit CNG buses, to ease the cost of transportation and the civil service reforms to improve the efficiency of government amongst others.

“The major factor driving inflationary pressure remains exchange rate pass-through, the rising cost of energy, high fiscal deficit, and lingering security challenges in major food-producing areas.

“In addition, global factors such as tight financial condition and trade disruptions, from ongoing geopolitical tension, remained significant offside risks for the outlook of domestic inflation.”

He added that there are predictions that “inflation will remain on an upward trajectory in the near term before commencing a descent.”

The CBN boss said the real GDP growth improved in the 4th quarter of 2023 to 3.46 per cent compared with 2.54 per cent in the previous quarter driven by both the improvement of oil and nonoil sectors.

He added that forecasts indicate that the economy will grow in 2024 by 3.38 per cent (CBN estimate) and 3.88 per cent, (federal government of Nigeria estimate), and 3 percent (IMF estimate).

He disclosed that the growth of Nigeria’s external reserve stood at $34.51 billion on 20 February 2024 compared with 32.23 billion at the end of January 2024.

He explained that the improvement was driven by foreign exchange market activities and an increase in oil production amongst others.

“In the global economy, inflation is projected to continue to moderate in 2024 but could remain above the long-term objectives of several advanced economies’ central banks. Consequently, policy rates amongst this group of central banks are expected to remain high in the short to medium term.”

He also stated that the committee recognized the need to continue to put in place, measures to boost investor confidence and to attract capital inflows.

“To this end, the committee will continue to monitor developments in the global and domestic economies to ensure that inflationary and exchange rate pressures moderate in the near term,” Cardoso added.

He said the next MPC meeting will held on 25 and 26 March 2024.

Victor Ezeja is a passionate journalist with six years of experience writing on economy, politics and energy. He holds a Masters degree in Mass Communication.

Follow Us