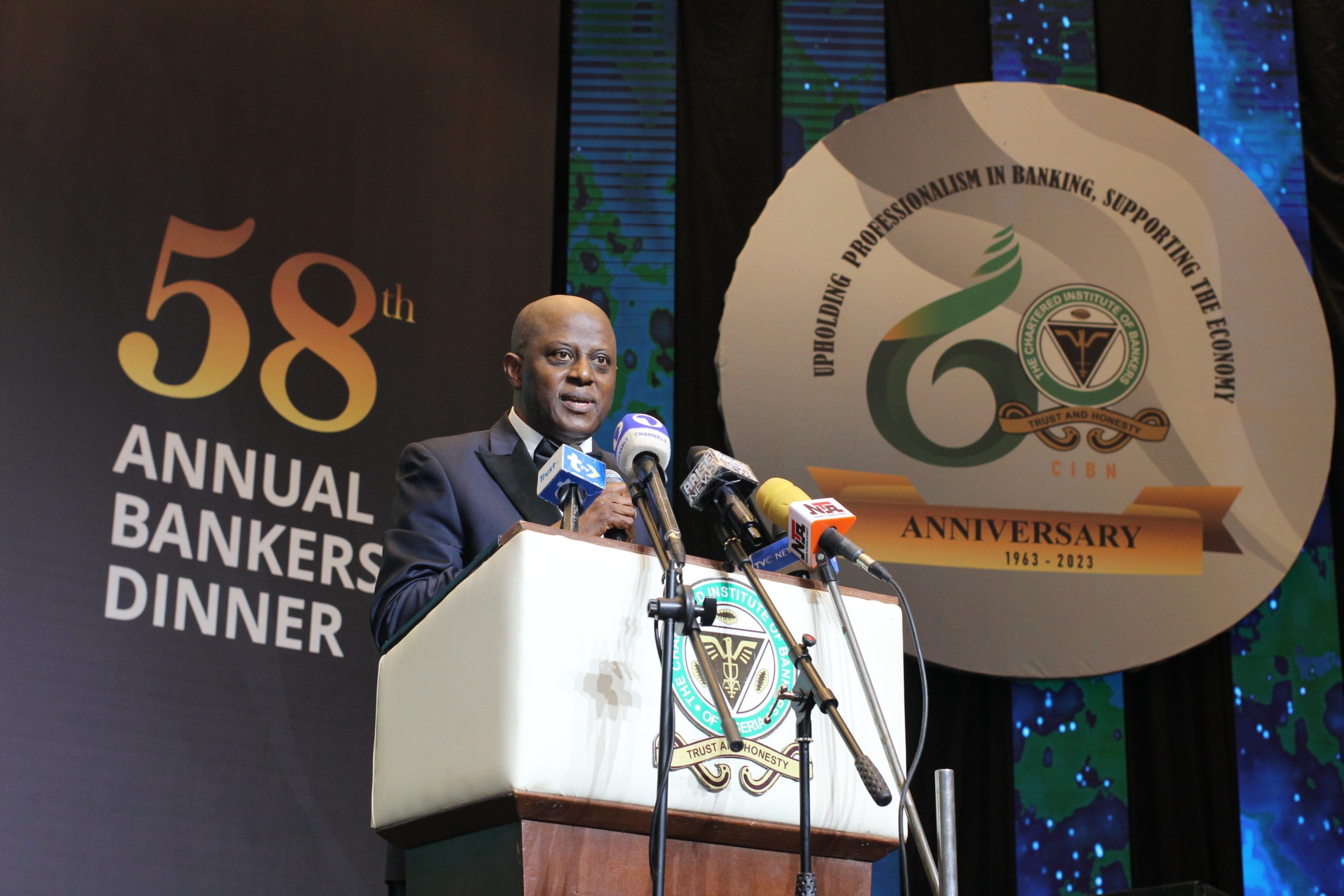

The Central Bank of Nigeria (CBN) Governor, Yemi Cardoso, has predicted a decline in persistently rising inflation and exchange rates in 2024.

Addressing the Joint Committee on Banking, Insurance, and Other Financial Institutions in Abuja on Thursday, Cardoso emphasized, “The outlook for the domestic economy remains positive and is expected to maintain the positive trajectory for 2024.”

Join our WhatsApp ChannelHe added, “Inflation pressures may persist in the short term but are expected to decline in 2024,” expressing confidence in the stabilization of both inflation and exchange rates.

Cardoso revealed that the total trade from the Nigerian Foreign Exchange Market (NFEM) hit N18.804 billion in the third quarter of 2023, signaling noteworthy market activity. He stated, “Exchange rate pressures are also expected to reduce significantly with the smooth functioning of the foreign exchange market.”

READ ALSO: Cash Scarcity: CBN Blames Hoarding, Says N3.4trn In Circulation, Surpassing Pre-redesign Level

Highlighting a shift in the foreign exchange market strategy, the CBN Governor noted the consolidation of exchange rate windows in June, aiming to diminish arbitrage, discourage rent-seeking behavior, and curb speculation.

“The policy aims to create a market where the demand and supply of foreign exchange determine the exchange rate,” he explained, noting a narrowing premium and a focus on increasing autonomous FX supply for stability.

On the revenue front, Cardoso foresees a decrease in income from the oil industry in 2024, attributing it to Nigeria’s OPEC quota pegged at 1.78 million barrels per day. He cited challenges such as crude oil theft, production shut-ins, and divestment from oil majors as contributing factors to the country’s struggling oil production.

In the broader economic context, Nigeria has faced a persistent increase in inflation, reaching 27.33% for November, the highest in 18 years. While KPMG predicts a further rise to 30% by December, the federal government projects a drop to 21.4% in 2024, according to the budget proposal.

The Nigerian naira has also experienced a devaluation, losing over 50% of its value since the CBN unified the foreign exchange market in June, with the parallel market seeing the naira trade at over N1000 to the USD this month.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

Follow Us