Nigeria’s President Bola Tinubu signed the national budget of N54.99 trillion into law Friday last week, marking the first time the country has had such a large budget that surpassed the previous year by almost 100 per cent.

Big and ambitious as the budget may seem, given the government’s quest for fiscal stability and leapfrogging national development, there are concerns that the country may be plunged into a bigger debt burden if it fails to achieve the revenue target set for the 2025 fiscal year.

Join our WhatsApp ChannelTinubu, who earlier proposed ₦49.7 trillion, had later on 5 February, communicated to the National Assembly to raise it to ₦54.2 trillion, citing additional revenues generated by key government agencies. The President had claimed that the Nigeria Customs Service (NCS) brought in ₦1.2 trillion, the Federal Inland Revenue Service (FIRS) brought in ₦1.4 trillion, and other government-owned organisations brought in ₦1.8 trillion.

The National Assembly subsequently increased it to ₦54.99 trillion that was passed on 13 February 2025.

Budget Breakdown

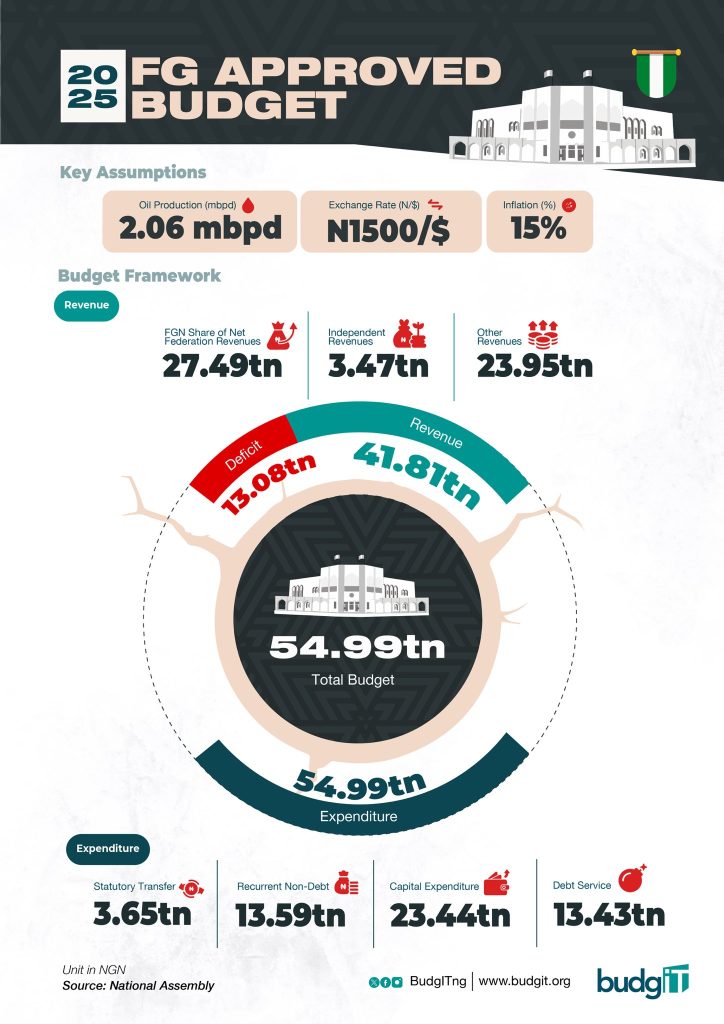

A breakdown of the ₦54.99 trillion 2025 Appropriation Bill signed into law, shows that the Federal Government targets to generate a revenue of ₦41.81 trillion, leaving a deficit of ₦13.08 trillion.

Further breakdown of the revenue indicates that the Federal Government’s share of net federation revenues is ₦27.49 trillion. While independent revenues will generate ₦3.47 trillion, ₦23.95 trillion will come from other revenue sources.

On the expenditure side of the budget, ₦23.44 trillion has been earmarked for Capital expenditure and recurrent non-debt expenditure, ₦13.59 trillion. Debt service will gulp ₦13.43 trillion, while statutory transfer will amount to ₦3.65 trillion.

The approved budget is anchored on an oil production rate of 2.06 million barrels per day, $75 per barrel benchmark, an exchange rate of ₦1,500 per dollar, and an inflation rate of 15 per cent.

Worries About Realising 2025 Revenue Target

Analysts have averred that unless the country significantly boosts its revenue mobilisation capacity, maybe well above 100 per cent, this year, the enlarged 2025 budget revenue target may worsen the Federal Government’s already vulnerable fiscal situation.

Earlier, the Federal Government had proposed ₦36.35 trillion revenue which Nigerians saw as an ambitious target given the revenue generation history of the country over the years.

The Nigerian Institute of Social and Economic Research (NISER), while analysing the budget stressed that its successful implementation “requires effective fiscal-monetary coordination, improved revenue mobilisation, and structural reforms to tackle inflation, exchange rate volatility, and social inequalities, while enhancing economic diversification and governance.” It further noted that achieving the ambitious revenue target, managing debt servicing, and stabilising the naira will be key to fostering sustainable growth, boosting investment, and meeting the projected GDP growth of 4.6 per cent.

However, while speaking during the budget signing ceremony on Friday, 28 February 2025, in the presence of key National Assembly leaders, President Tinubu expressed optimism that the uncertainty over the economy was gradually fizzling out as the reforms of his administration are taking shape. He cited a recent report of the national GDP growth of 3.86 per cent in the last quarter of 2024, the fastest in three years, and increased revenue in the previous year.

“Revenue increased to ₦21.6 trillion from ₦12.37 trillion, reflecting our drive for fiscal efficiency and the deficit reduced significantly—from 6.2% in 2023 to 4.17% in 2025,” the Nigerian leader stated.

READ ALSO: 2025 Budget: Why Debt Servicing Matters

While the Federal Government realised ₦21 trillion in 2024, according to the president, the possibility of doubling it to achieve the ₦41.81 trillion revenue target in 2025 remains uncertain.

The present administration had embarked on reforms such as launching new revenue drives and broadened tax programmes aimed at increasing public revenue. However, political factors have slowed the reforms, and there are doubts as to whether the much-needed implementation will begin this year.

If the reforms do not receive legislative approval, the government’s ambition to raise tax income may remain a pipe dream, limiting it to the traditional petrodollar source. The tax reform bills sent to the National Assembly to get legal backing for overhauling the tax system for efficiency and enhancing revenue generation drive have suffered a setback as many political stakeholders kicked against some of the provisions in the bills, leading to further consultations for input and possible compromise.

Relying on Petrol dollar

On the option of relying on crude oil revenue, there are concerns that the volatility of prices in the international market makes it uncertain. The prices are influenced by a complex interplay of factors, including supply and demand dynamics, geopolitical events, economic conditions, and market speculation.

Also, the United States President Donald Trump’s policy direction on energy is, according to economic analysts, going to affect global crude prices. Trump signed an Executive Order that has set off a series of actions aimed at increasing oil output to reduce energy prices in the USA and globally.

CEO of the Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, who recently highlighted the impact of Trump’s policies on the Nigerian economy, said there is “Heightened prospects of a drop in oil prices,” which would “negatively impact government revenue and foreign exchange earnings.” This, according to him, has implications for the country’s revenue outlook, fiscal deficit, government debt and exchange rate. He also expressed worry that if that pulls through, the $75 per barrel crude oil benchmark in the 2025 budget may not be feasible.

Oil price versus Budget Benchmark

With the assumption of 2.06 mbpd, at $75 per barrel, the 2025 budget projects an oil revenue of about N20 trillion.

However, there are worries about a drop in oil prices. For the first time this year, the price of Brent crude slipped to $72.64 per barrel on Monday, 24 February 2025. It further plunged, cascading to $69.43 per barrel as of Thursday, 6 March 2025.

This declining crude oil price, according to a Lagos-based economist, Marcel Okeke, poses a threat to the 2025 budget, which already has a deficit of over N13 trillion.

According to Okeke, a former Chief Economist at Zenith Bank, the direct impact of US energy policy is the loss of the U.S. as a market for Nigeria’s oil. “The declining oil price trend particularly imperils the funding of Nigeria’s 2025 budget — since the Appropriation Act is hinged on significant income from crude oil sales. The budget is already laden with an indeterminate quantum of deficit — due to the declining oil prices,” he stated.

Oil sector contribution to GDP

In the gross domestic product (GDP) data for last year as released recently, the oil and gas sector’s contribution to output significantly dropped below five per cent, for the first time in a while, raising concerns that crude, the nation’s primary source of public funding, is waning.

This, according to analysts, means that the government may be forced to take more loans to finance the large size budget if taxes and crude fail, thereby increasing the debt burden.

The enlarged budget already calls for more borrowing to cover deficits of almost N14.2 trillion. There are indications that if the government doesn’t take drastic measures and even cut down on spending, the number might be significantly higher.

To improve revenue generation, experts submitted that Nigeria must address the challenges through economic diversification, improved tax administration, political stability, and investment in technology and infrastructure. Strengthening institutions, reducing corruption, and fostering public trust are also critical for sustainable revenue growth.

Victor Ezeja is a passionate journalist with six years of experience writing on economy, politics and energy. He holds a Masters degree in Mass Communication.