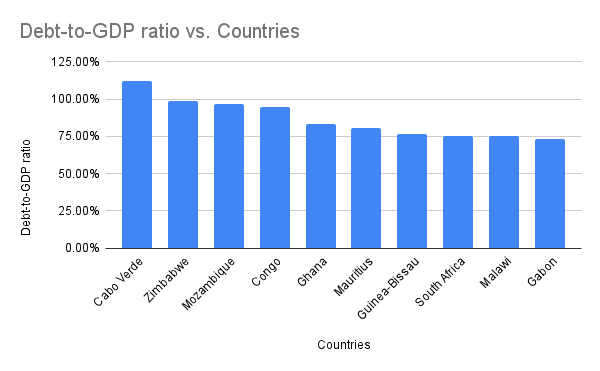

What Is Debt-to-GDP?

Debt-to-GDP-ratio is an economic indicator that measures how much debt a country has in relation to its Gross Domestic Product (GDP). Often expressed as a percentage, the ratio is used to measure a country’s ability to repay its debt. It compares a country’s public debt to its annual economic output.

Economic experts have averred that it is not desirable to have a high debt-to-GDP ratio because the higher the ratio, the less likely a country will be able to repay its debt, leading to a possible default. A World Bank study found that a ratio that exceeds 77 per cent for an extended period of time may result in an adverse impact on economic growth.

Join our WhatsApp ChannelDue to varying external circumstances, government policies, and economic conditions, debt-to-GDP ratio vary significantly among African nations. While some African countries experience high level of financial distress due to debt, others can boast of sustainably managing their debts.

When making investment decisions, foreign investors often take into account a country’s debt-to-GDP ratio. The investors tend to go for those with lower ratios since they carry a lower default risk, which could result in lower interest rates on government bonds.

In this article, Prime Business Africa presents 10 countries with the highest debt-to-GDP ratio in 2024.

According to the International Monetary Fund (IMF), here are Africa’s top 10 indebted countries according to their debt-to-GDP ratio.

READ ALSO: IMF Calls For Urgent Tax Reforms As Debt-stricken Nations Face Mounting Challenges

Cabo Verde – 112.24% Debt-to-GDP Ratio

Cape Verde officially known as the Republic Of Cabo Verde, is an island country off the west coast of Africa. IMF latest data show that the country has a debt-to-GDP ratio of 112.24 per cent, being the highest in Africa.

The country which depends mostly on tourism, was impacted by the COVID-19 pandemic, leading to increased borrowing that made its debt-to-GDP rise to a high of 153 per cent in 2021, and later dropped to 127.5 per cent in 2022. The country subsequently recorded some measure of improvements, but the debt-to-GDP remains high. According to a World Bank report in June, the country had its economic growth decline to 5.1 per cent in 2023. The Bank said there is a forecast that the real GDP growth in 2024 will be around 4.7 per cent, supported by structural reforms and further drop of the inflation rate.

It however, noted that the country faces considerable risks, including potential increases in commodity prices, climate-related shocks and “excessive dependence on tourism”, which makes it vulnerable to external shocks. The Bank therefore recommended urgent reforms focusing on investment in blue economy by harnessing its marine resources in a sustainable way to mitigate the vulnerability.

Zimbabwe – Debt-to-GDP ratio 98.48%

Zimbabwe, a landlocked country in southern Africa, has a debt-to GDP of 98.48 per cent being the second highest indebted country in the continent. The country’s economy is mainly powered by Agriculture and mining exports. The economy had been battered by hyperinflation in at least the last decade owing to sharp decline in agricultural production. According to the Zimbabwe Economic Outlook released by the African Development Bank group, the country’s real GDP growth dropped from 6.1 per cent in 2022 to 5.0 per cent in 2023, mainly due to drought and floods that affected agricultural output, and also higher costs of fuel and food imports

Mozambique – Debt-to-GDP ratio 96.91%

Located in south-east Africa with a population of about 33 million according to World Bank, Mozambique maintains a debt-to-GDP ratio of 96.91 per cent. The country has suffered a debt crisis since 2016. Formerly, Mozambique was one of the world’s 10 fastest-growing economies for two decades attracting 10–15 per cent of total foreign direct investment (FDI) inflows into Sub-Saharan Africa, but that came to a halt following the discovery of several state-backed loans obtained without parliamentary approval.

The discovery of what was now described as “hidden” loans degenerated into crisis that plunged Mozambique into a protracted economic downturn. “These loans breached the International Monetary Fund (IMF) program in place at the time, and the International Development Association’s non-concessional borrowing policy, resulting in the outright suspension of budget support by both institutions and other development partners” a World Bank report had said. Economic Growth sharply declined from 7.7 per cent in 2016 to 3.3 per cent in 2019.

Also, the exposition of the hidden liabilities impacted Mozambique’s external public and the debt-to-GDP ratio ballooned from 61 per cent in 2016 to 104 per cent in 2018. Since then, the country has continued to struggle to restructure its debt and implement economic reforms amid fiscal challenges.

Congo Republic – Debt-to-GDP ratio 94.61%

With 6.309 million population, Congo has a debt-to-GDP ratio of 94.61 per cent. With its economy dependent on oil extraction activities, Congo Republic has recorded slow economic growth since the post-2015 decline in global oil prices. Volatility of oil prices has over time posed fiscal challenges to the Central African country, making it imperative for the authorities to focus on economic diversification.

According to IMF data, the country’s real GDP growth rate is projected to be around 4.4 per cent in 2024.

Ghana – Debt-to-GDP ratio 83.59%

Ghana, which had had a measure of economic progress in the last decade, is now faced with the burden of mounting debt with its debt-to-GDP standing at 83.59 per cent. It had reached 92.4 per cent in December 2023 before it started dropping.

According to AfDB’s report titled “Ghana Economic Outlook”, the West African country’s real GDP growth slowed to 3.3 per cent in 2022 from 5.4 per cent in 2021 due to macroeconomic instability, global financial tightening, and spillover effects of Russia’s invasion of Ukraine

Mauritius – Debt-to-GDP ratio 80.95%

Mauritius has a debt-to-GDP ratio of 80.95 per cent. With about 1.26 million people, the island country’s economy is based on agriculture, exports, financial services, and tourism. According to World Bank, the country had recorded remarkable growth since independence in 1968, briefly reaching high-income country status in 2020, but the economy was hit hard by the global COVID-19 pandemic as its GDP contracted by 14.6 per cent in 2020, “causing Mauritius to slide down to upper-middle-income country status.”

READ ALSO: Top 15 African Countries With Strongest Currency Exchange Rate

The Mauritius’s economy demonstrated resilience in the face of other global economic shocks, leading to rebound in GDP growth in 2021 (3.5 per cent) and 2022 (8.9 per cent). It however, dropped slightly to 7 per cent in 2023. The economic recovery measures of the government had seen Gross public debt decreased from 86.1 per cent of GDP in 2022 to 79 per cent in 2023. The recent increase highlights growing level of its debt burden and the need to sustainably manage it and achieve long-term fiscal stability.

Guinea-Bissau – Debt-to-GDP ratio 76.5%

Being one of the world’s least developed countries, Guinea-Bissau’s economy depends mainly on agriculture and fishing, with cashew nut being the major export crop. Political crises at some points in the country’s history have also impacted the economy.

The debt-to-GDP ratio went up after public debt rose from 78.5 per cent in 2021 to more than 80 per cent in 2022. Addressing the challenge requires strategic approach to achieve sustainable economic growth in the long-term.

South Africa – Debt-to-GDP ratio 75.44%

Though being one of Africa’s biggest economy, South Africa has high debt-to-GDP ratio of 75.44 per cent.

The country’s economic growth has, according to a World Bank review, been affected by a couple of factors over the years. These include power supply shortages, structural issues, and lingering effect of COVID-19 pandemic. “South Africa’s GDP has recovered to its pre-pandemic levels, but the strength of the recovery has been hindered by multiple structural constraints, including ongoing power shortages and logistics bottlenecks,” the World Bank report observed. The challenges require coordinated efforts to stabilize the economy.

Malawi – Debt-to-GDP ratio 74.94%

Malawi, a landlocked country in southeastern Africa with a population of about 21.5 million, has a debt-to-GDP ratio of 74.94 per cent as of June 2024. This is despite making significant economic and structural reforms to sustain economic growth. The country’s economy is heavily dependent on agriculture, which employs over 80 per cent of the population, according to World Bank. The country is also vulnerable to climate-related shocks. There is need for economic diversification to boost the economy

Gabon – Debt-to-GDP ratio 73.11%

Gabon currently has a debt-to-GDP ratio of 73.11 per cent. Located in Central Africa, Gabon has a wealth of natural resources which has not been adequately harnessed to yield sustainable and inclusive growth. Public debt rose 78.29 per cent of the GDP in 2020, dropped to 65.82 per cent in 2021, and 63.7 per cent in 2022 before rising to 70.5 in 2023.

According to Statista, debt-to-GDP in Gabon was forecast to increase to 102.84 per cent by 2029.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.